Modest-enterprise homeowners are faring Okay economically proper now, but their problems about the future are mounting, according to a new Little-Business Financing Index from NerdWallet.

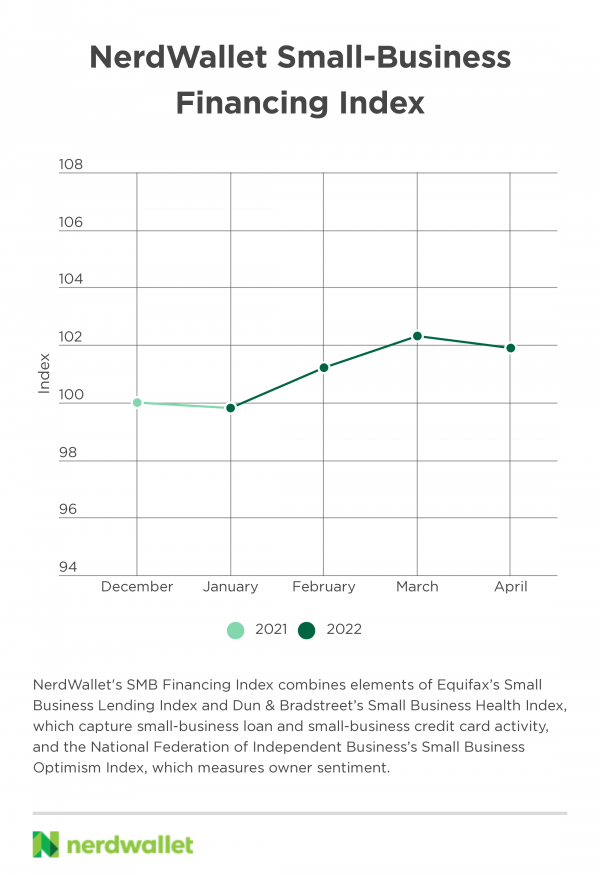

This is the 1st installment of the NerdWallet SMB Funding Index. It tracks and weights knowledge from many resources, starting in December 2021. Potential index readings are often relative to the first entry of 100. For case in point, an index studying of 110 would show that the index has risen by 10% since December 2021.

Monitoring this data gives a steady glimpse into the economic context in which modest corporations function. The capability to get, deploy and repay financing is crucial to several tiny corporations. Variations in financing exercise can signal an enlargement or contraction in all round business action.

All round, the index has been rather flat given that the commencing of the year, suggesting that funding-similar activity has held constant. Right after a slight dip in January, the index, which evaluates components this sort of as delinquency costs, new loan volumes and optimism among small-business house owners about long run economic ailments, rose a bit in February and March.

Having said that, in April, the most latest entry, the index dipped to 101.9, a decrease of .4 share points from the prior thirty day period. New financial loans and healthful credit card repayment fees have aided nudge the index bigger given that January 2022, but the index’s underlying details suggests increasing curiosity costs and deflating optimism have began to weigh on tiny-business enterprise entrepreneurs.

Recent index dips to 101.9

The overall increase in the index given that the get started of 2022 suggests that modest organizations may be increasing their use of funding, that they are capable to pay their loans on time and that proprietors are getting ready to expend in purchase to satisfy expected future demand from customers. Small-business enterprise mortgage volume has risen modestly considering that January, even though that tempo slowed in April. Credit rating card utilization (the share of a card’s credit score limit that a cardholder utilizes for buys), a further indication of growth, has also ticked slightly greater.

Nonetheless, organization owners have grow to be much more pessimistic about foreseeable future sales, and fewer prepare to increase inventories, in accordance to the facts. Source chain challenges, inflation and geopolitical tumult have only intensified given that April. If more tiny enterprises prevent in search of funding, battle to repay financial loans or have a much more defensive state of mind towards the coming months, the index may well go on to fall. And mainly because it can consider a handful of months for some loans to go from application to completion, a slowdown in new financial loan apps right now could possibly not still look in recorded data.

Tiny firms plan for an uncertain foreseeable future

It doesn’t get mental gymnastics to relate to the mentality of a little-company operator. “Small business enterprise entrepreneurs get worried about all the similar points buyers do,” claims Lori Martinek, a Los Angeles-based mostly certified mentor with Rating, which presents no cost organization coaching nationwide.

Increasing costs are making a dent in home budgets and little businesses alike. In addition, a slowdown in a single pocket of the economy can have spillover outcomes in many others, which includes smaller organizations, states Frank LaMonaca, a accredited mentor with Rating. Creation cuts at massive automakers could have an impact on tiny corporations that manufacture vehicle sections, and eating places near hotels could possibly struggle if organization and leisure travel dries up, for example.

A nationwide slowdown in small-business enterprise exercise could have a extensive affect. The U.S. has about 8 million compact corporations, in accordance to the U.S. Census Bureau, and these small businesses account for about 40% of the country’s economic action, according to the U.S. Little Business enterprise Administration.

“We normally utilised to say in banking that when you make a personal loan to a smaller business, you are not becoming repaid by them you are becoming repaid by their customers,” says LaMonaca. “That’s what financial institutions do, which is what modest enterprises have to have to glimpse at, way too.”

Experts say: Do these 7 issues now

1. Make plans for a vary of results

Martinek claims uncertainty is a motive to plan a lot more, not fewer. Creating strategies for a variety of circumstances, which includes an financial downturn, could get ready you to transfer promptly on whichever the foreseeable future retains. “You can’t pivot if you’re not prepared to act,” she suggests.

2. Enjoy the calendar

Securing funding need to be the previous detail to scuttle if you are looking at shifting from a single program to an additional. “Applying for credit is not a brief method,” Martinek claims. “Make guaranteed that if you want the money tomorrow, you can get it tomorrow.”

3. Mind your funds stages

“I applied to propose 6 months of liquidity [for new businesses],” states LaMonaca. “Now I propose 12 months.” The adjust in recommendation is in immediate reaction to uncertainty. “If you’re in enterprise suitable now, I’d say people that make it have the more powerful funds flows.”

4. Minimize spending wherever you can

Preparing for a downturn could signify obtaining the capability to withstand decreased revenues or the ability to take benefit of a unexpected chance, Martinek claims. To reinforce your funds placement, minimize costs. For case in point, delay acquisitions if you can and streamline inventory where by achievable.

5. Remove slack in company functions

Tweaking how you do small business can also strengthen your cash position, Martinek claims. If you concern invoices, for example, concentrate on lowering current excellent payments and increasing potential payment times.

6. Retain paying your payments

“The No. 1 factor you can do is shield your credit score score so that when you do have a require in the potential, that is not going to hold you back,” states Martinek.

7. Speak to your banker right before a default

Routine a time to talk to your banker. “If you don’t have a regional marriage, get a single now,” states Martinek. Share your strategy for weathering a achievable downturn. They must be capable to support troubleshoot your strategy, and they may offer you proactive answers, like refinancing loans now to decrease your regular monthly payment. “Your community banker has a lot additional versatility to give you new conditions before a default,” says LaMonaca. “After you are 30 or 90 days earlier owing, their palms are tied. Their selections to support you are greatly diminished.”

METHODOLOGY

NerdWallet’s SMB Funding Index brings together features of Equifax’s Smaller Company Lending Index and Dun & Bradstreet’s Smaller Company Overall health Index, which seize little-organization loan and tiny-enterprise credit rating card action, and the Countrywide Federation of Impartial Business’s Smaller Business Optimism Index, which steps owner sentiment.

The write-up Small Companies Are Continual Now but Be concerned About the Long term initially appeared on NerdWallet.

More Stories

Think three times before you customize

Where to Start with Local SEO

Charting the global economy: inflation eases from US to Europe