ipopba/iStock by means of Getty Illustrations or photos

New Mountain Finance (NASDAQ:NMFC) is a business improvement enterprise with a rising and properly-managed portfolio, floating publicity that signifies greater portfolio money as fascination costs rise, and a reduced non-accrual price.

Additionally, the enterprise improvement firm addresses its dividend payments with web financial investment money, and the stock at present trades at a 13% discounted to e-book worth. The inventory is desirable to dividend investors in search of substantial recurring dividend earnings, even though NMFC’s reduced valuation relative to guide worth leaves place for upside.

Getting A 10% Produce At A Discount

Under the Expenditure Company Act of 1940, New Mountain Finance is labeled as a Small business Development Business. The BDC is managed externally, which suggests it pays yet another enterprise for administration expert services. New Mountain Finance principally invests in center-current market providers with EBITDA of $10 to $200 million.

The majority of New Mountain Finance’s investments are senior secured debt (initial and second lien) in industries with defensive characteristics, which implies they have a substantial likelihood of doing well even in recessionary environments. New Mountain Finance’s main organization is center marketplace personal debt investments, but the firm also invests in net lease houses and fairness.

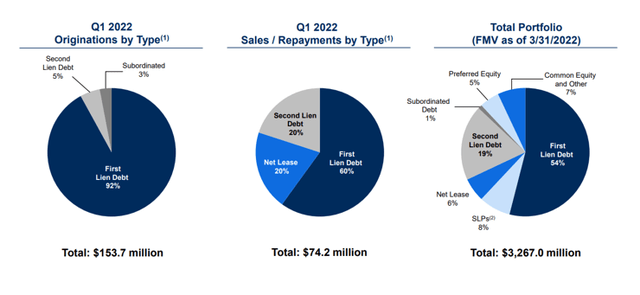

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% first lien financial debt and 19% 2nd lien credit card debt, with the remainder distribute throughout subordinated personal debt, fairness, and web lease investments. In the initial quarter, almost all new financial loan originations (92%) were being very first lien credit card debt.

The total exposure of New Mountain Finance to secured to start with and 2nd lien personal debt was 73%. As of March 31, 2022, the company’s whole portfolio, like all debt and fairness investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

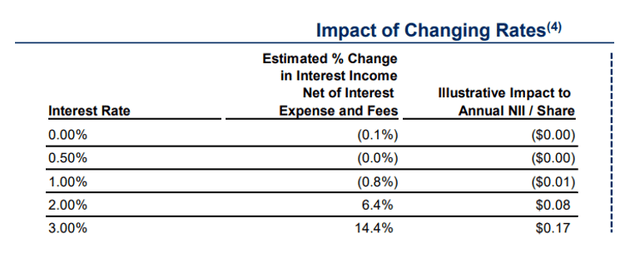

Curiosity Fee Publicity

New Mountain Finance has taken care to commit generally in floating amount financial debt, which assures the expenditure business a personal loan charge reset if the central bank raises desire charges. The central lender raised interest fees by 75 foundation factors in June to battle mounting inflation, which strike a 4-10 years substantial of 8.6% in May perhaps. An increase in benchmark curiosity fees is predicted to result in a considerable boost in net curiosity earnings for the BDC.

Affect Of Switching Fees (New Mountain Finance Corp)

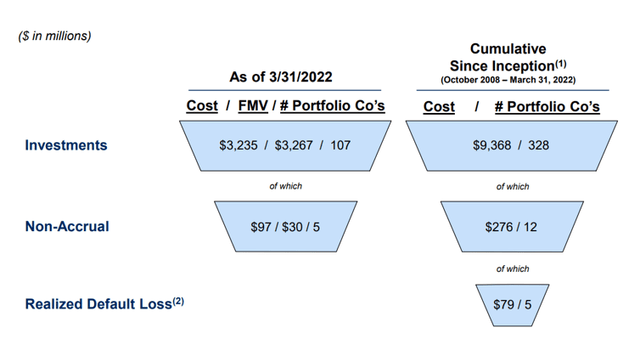

Credit score Overall performance

The credit rating overall performance of New Mountain Finance is outstanding. As of March, five of 107 companies had been non-accrual, symbolizing a $30 million good value publicity. Due to the fact the BDC’s whole portfolio was truly worth $3.27 billion in March, the non-accrual ratio was .9%, and the company has still to acknowledge a decline on people investments.

Non-Accrual Ratio (New Mountain Finance Corp)

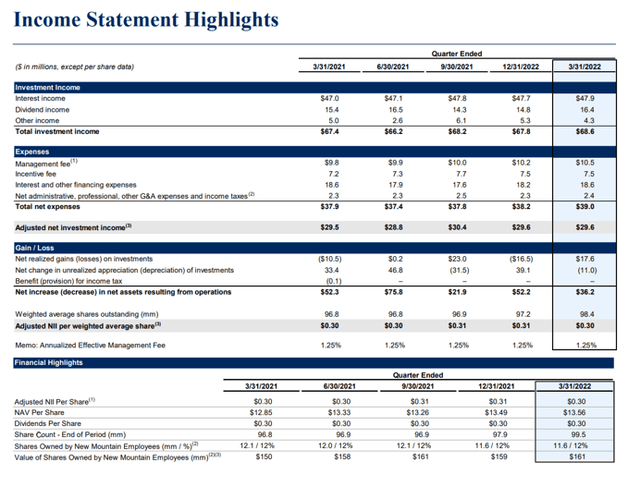

NII Handles $.30 For every Share Quarterly Dividend Fork out-Out

New Mountain Finance’s dividend of $.30 per share is included by modified net expenditure revenue. In the earlier yr, New Mountain Finance experienced a pay out-out ratio of 98.4%, indicating that it has constantly covered its dividend with the income created by its personal loan investments.

Even though New Mountain Finance presently addresses its dividend with NII, a deterioration in credit score excellent (mortgage losses) could bring about the BDC to beneath-receive its dividend at some place in the future.

Cash flow Assertion Highlights (New Mountain Finance Corp)

P/B-Multiple

On March 31, 2022, New Mountain Finance’s ebook price was $13.56, although its inventory selling price was $11.84. This signifies that New Mountain Finance’s investment portfolio can be acquired at a 13% price cut to reserve benefit.

In current months, BDCs have begun to trade at greater discount rates to ebook worth, owing to fears about growing interest prices and the likelihood of a recession in the United States.

Why New Mountain Finance Could See A Reduce Valuation

Credit history good quality and e-book benefit tendencies in organization progress companies demonstrate investors no matter whether they are dealing with a responsible or untrustworthy BDC. Firms that report poor credit score top quality and ebook price losses are generally pressured to reduce their dividends. In a downturn, these BDCs need to be averted.

The credit history quality of New Mountain Finance is powerful, as calculated by the amount of non-accruals in the portfolio. Credit good quality deterioration and ebook value losses are threat aspects for New Mountain Finance.

My Summary

New Mountain Finance is a very well-managed and reasonably priced company development enterprise to make investments in.

Presently, the stock selling price is lower than the NMFC’s e-book price, implying that the BDC can be bought at a 13% discounted to guide value.

Furthermore, New Mountain Finance’s all round credit rating excellent appears to be favorable, and the small business enhancement organization addresses its dividend payments with net investment money.

More Stories

Apple Supplier Reportedly Sees Full Production Comeback At COVID-Hit China Plant By Early Jan – Apple (NASDAQ:AAPL), Hon Hai Precision (OTC:HNHPF)

How to Tease What’s Coming Ahead of Your Virtual Event

Social Security Payments Assume Importance In Absence Of Stimulus Checks: Check The December Payment Dates