MELBOURNE, Australia, May possibly 09, 2022 (World NEWSWIRE) — With SMEs facing quite a few hurdles through the past two yrs, Liberty suggests exploring flexible organization loans can assistance enterprise homeowners put together for upcoming unanticipated gatherings.

From cyberattacks to offer chain disruptions, labour shortages and a world wide pandemic, Australian SMEs have dealt with a variety of unexpected challenges impacting their functions.

Even though optimism is developing amid business enterprise proprietors now rebounding from these challenges, focus should really now flip to for a longer time-expression arranging and preparing.

Securing quickly entry to funding as a result of a small business bank loan forward of time can provide businesses with an more cash buffer when the unanticipated comes about.

For non-lender lender Liberty, helping business enterprise entrepreneurs actively get ready for the long term with the appropriate finance answer is an important part of their provider.

Liberty’s Head of Client Communications, Heidi Armstrong, mentioned: “With aid from professional creditors these kinds of as Liberty, Australian little companies have larger opportunities to return to complete energy and achieve their objectives.”

Adopting a personalised solution makes it possible for Liberty to provide customized methods suited to the exclusive wants and conditions of each small business proprietor.

Even though several organizations are however searching for traditional business financial loans, Liberty claims line of credit score services are an ever more well-known option for SMEs thanks to their adaptability.

Liberty Obtain is the lender’s personal line of credit business mortgage created to support firms acquire the credit rating they require to increase, seize new alternatives and do well. Contrary to other business loans, Access only sees desire billed on the sum employed.

Typical takes advantage of for line of credit rating services this sort of as Liberty Entry include things like shelling out workers wages, covering invoices, obtaining urgent inventory and shelling out suppliers.

Liberty also provides interest-only solutions and small business loans without the need of home loan security needs. And, with quickly turnaround occasions, Liberty is effectively-outfitted to aid small business clients to obtain money when required.

Even these with a fewer-than-fantastic company credit score are inspired to discuss with a Liberty Adviser for support to locate a solution that matches their demands. There may possibly be a lot more options out there than initially assumed.

Authorized candidates only. Lending standards use. Expenses and costs are payable. Liberty Money Pty Ltd ACN 077 248 983 and Protected Funding Pty Ltd ABN 25 081 982 872 Australian Credit rating Licence 388133, with each other investing as Liberty Economical.

Get in touch with

Heidi Armstrong

Group Manager – Customer Communications

P: +61 3 8635 8888

E: [email protected]

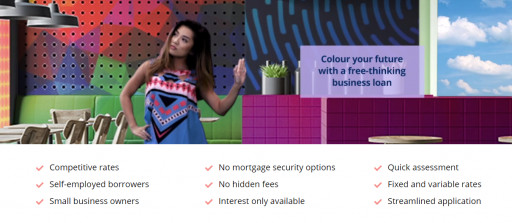

Similar Illustrations or photos

Impression 1: Small business Loans

Company Loans

This written content was issued through the push release distribution services at Newswire.com.

More Stories

US Tariffs on Chinese Goods: What Businesses Need to Know

Keeping Your Garage Door Running Smoothly: The Importance of Garage Door Opener Services

Heavy Duty Towing and Its Impact on Traffic Incident Management