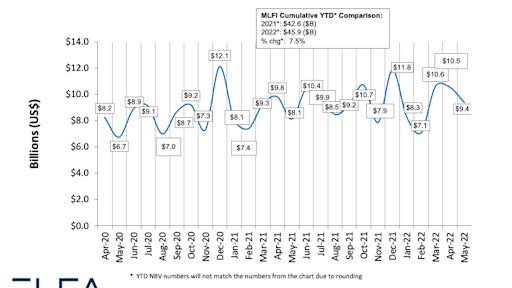

The Machines Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index showed general new business volume for Might was $9.4 billion, up 16% year-above-year from new small business volume in Might 2021.

ELFA

The Devices Leasing and Finance Association (ELFA) has released its Monthly Leasing and Finance Index for Might.

The index, which experiences economic exercise primarily based on feed-back from 25 companies inside of the devices finance sector, was $9.4 billion, up 16% yr-above-12 months from new company quantity in Could 2021. Quantity was down 10% from $10.5 billion in April. 12 months-to-date, cumulative new business enterprise quantity was up just about 8% in contrast to 2021.

“May activity for MLFI-25 machines finance organization participants demonstrates powerful origination quantity and quite secure credit history excellent metrics,” reported Ralph Petta, ELFA president and CEO. “The financial system proceeds to offer work and company The united states, in standard, reports potent balance sheets—all in the facial area of a waning health pandemic. Offsetting this good information is higher inflation, creating havoc for many buyers, and ongoing offer chain disruptions and increased curiosity prices, which are squeezing substantially of the enterprise sector. As a final result, several gear finance providers method the summer season months with guarded optimism.”

Receivables were being 1.6%, down from 2.1% the past thirty day period and down from 1.9% in the exact time period in 2021. Cost-offs have been .12%, up from .05% the prior thirty day period and down from .30% in the 12 months-previously time period.

Credit approvals totaled 76.8%, down from 77.4% in April. Overall headcount for gear finance corporations was down 3% calendar year-about-calendar year.

The Products Leasing & Finance Foundation’s Every month Assurance Index (MCI-EFI) in June is 50.9, an improve from 49.6 in Might.

More Stories

US Tariffs on Chinese Goods: What Businesses Need to Know

Keeping Your Garage Door Running Smoothly: The Importance of Garage Door Opener Services

Heavy Duty Towing and Its Impact on Traffic Incident Management