]

Israeli thermal electrical power storage business Brenmiller Energy (TASE: BNRG) has filed a prospectus with the US Securities and Trade Commission (SEC) for a Nasdaq First Community Offering. The move will come virtually 5 many years soon after the organization held its IPO on the Tel Aviv Stock Exchange (TASE).

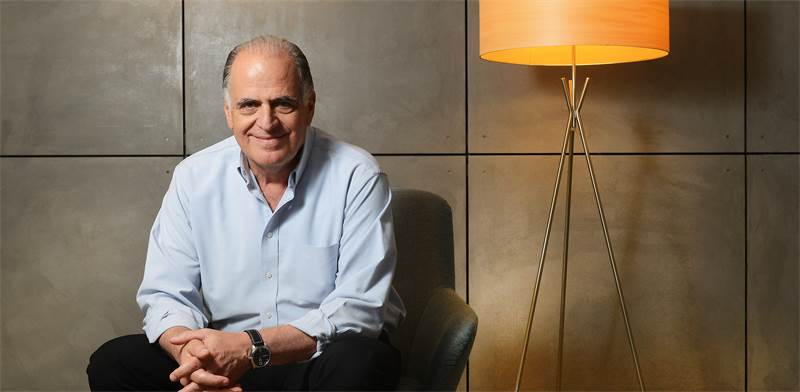

Brenmiller Power operates in the thermal vitality storage sector centered on technological know-how designed by chairman and CEO Avi Brenmiller, who founded the business in 2012, just after formerly founding and running Solel, which was offered to Siemens.

Linked Content articles

Brenmiller Electricity back from the brink

Rani Zim to commit NIS 50m in Brenmiller

Brenmiller engaged in 13m funding MOU with EIB

Brenmiller Power is traded on the TASE at a market place cap of NIS 232 million, tens of percentage details underneath its IPO valuation in 2017. The fall in its market place cap stems, among the other factors, from uncertainty concerning its skill to crank out earnings and fulfill the financing conditions prolonged to it by Financial institution Leumi (TASE:LUMI). At the end of 2020, Brenmiller Energy’s marketplace cap peaked at NIS 555 million but has since additional than halved.

In accordance to the prospectus submitted with the SEC, Brenmiller Energy will record on Nasdaq without having raising any funds though some of its shareholders may possibly sell shares as part of the presenting. Israeli economic institutions Alpha Cash and Mor Investments will together provide up to 3.3 million shares presently truly worth about NIS 58.5 million.

Avi Brenmiller himself retains a 36.4% stake in the business and Israeli businessman Rani Zim has a 15.1% stake. Neither will market any shares in the planned Wall Road giving.

In 2021, Brenmiller noted income of $395,000 and a web loss of $10.3 million, in contrast with a loss of $9.5 million in 2020.

Revealed by Globes, Israel small business information – en.globes.co.il – on April 25, 2022.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2022.

More Stories

Finding Your Voice And Using It To Make Ridiculously Good Content

5 takes from Wall Street analysts

Amazon announces AWS Clean Rooms